Integrating Sustainability Risks into the Daily Credit Risk Process

With FinAPU, sustainability risks can be easily integrated into the Daily credit risk process.

In order to achieve sustainability goals, policymakers and their associated regulators are attempting to use rules/laws to encourage market participants to protect the environment or to encourage investors to make "green" or "sustainable" investments. This has an indirect impact on corporate investments as well as on corporate liquidity and refinancing management:

According to policy, investors should be encouraged to refrain from refinancing industrial polluters. This almost certainly has an impact on the refinancing costs as well as the liquidity risk of these companies. This, in turn, leads to an increase in the risk of default. FinAPU has developed a methodology to make these risks quantifiable and incorporate them into daily risk assessment. This can be done both via a rating and an outlook.

The FinAPU methodology meets the following requirements:

- Easy to use

- Calculation logic that is easy to understand

- Consideration in the rating or outlook, depending on the selected process

- Integration into the model landscape in FinAPU

- Transparency & traceability

- Visual processing

- Compliance with regulatory and market requirements

New feature: The scenario calculators used by competitors or their in-house solutions on the market do not directly access the credit risk models, but form a calculation unit that is detached from the daily credit process. With the chosen methodology, FinAPU aims to use internal risk measurements for the scenario analysis for the first time and also take into account dependencies (e.g. financial market stability, caps, etc.). This calculation methodology has a significantly higher level of complexity and is intended to include not only the individual entities, but also the actual risks based on the individual transactions.

This access is only possible since FinAPU integrates the simulation directly into the platform and also maps the individual transactions of customers. With the help of the chosen methodology, a far more precise but also more transparent presentation of the risks should be possible and a more targeted investment strategy with regard to sustainability can be derived. The aim is to automate the incorporation of sustainability assessments into the credit risk process. However, this should also be able to be corrected by the user if there is an error.

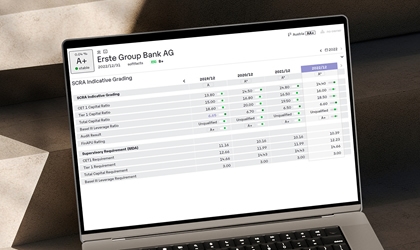

Current implementation of sustainability ratings in FinAPU

At the moment, an ESG recommendation is provided based on the available ESG information and the analyst can change the probability of default using a notching.